Urban realities and changing consumer behavior will lead to faster EV penetration

Feedback Consulting has been in the forefront of studying the developments in the EVs business in India having worked for stakeholders across the value chain from an OEM, Auto component firm, EV chargers, Charging infrastructure firm and even batteries for EVs since the 14-15 months.

Recently, we have come up with a Multi-Client Mega Trend Report on the future of EVs, EV charging infra and the EV chargers business in India along with a perspective of car owners in India on EVs. This study has bought some interesting facets which are set out below.

Fleet vs Personal

There was a time in India, when vehicles brands associated with taxis were supposed to be devaluing a brand value – e.g. Qualis, Premier Padmini, Ambassador etc. Today, fleet taxis are supposed to be a key driver for Auto OEM’s and each OEM is vying to be associated with fleet operators. This change is not overnight but over a period of time and with changing ground realities.

The urban transport system has not lived up to the growing urbanisation in India and the result is the current state of urban transportation systems in our cities. The choked roads, severe congestion, lack of or poor parking amenities and coupled with new traffic rules on drink & drive are some of the factors which had boosted the growth of fleet taxis in India.

Along with these ground realities, there have been several innovations in the fleet taxi market namely the advent of radio / app based fleet taxis, which have removed most of the issues related to taxi market namely:

- Convenience of booking a cab from the comfort of your home

- Complete negation of haggling on fees and transparent tariffs

- Refusal of the drivers to drop in certain locations

- Usage of the fleet car as per convenience – one drop, multi drop drives, rental options etc.

- Digital payments linked to cards / net banking / wallets

These innovations have led to huge growth of app / radio taxis in India over the last 2-3 years.

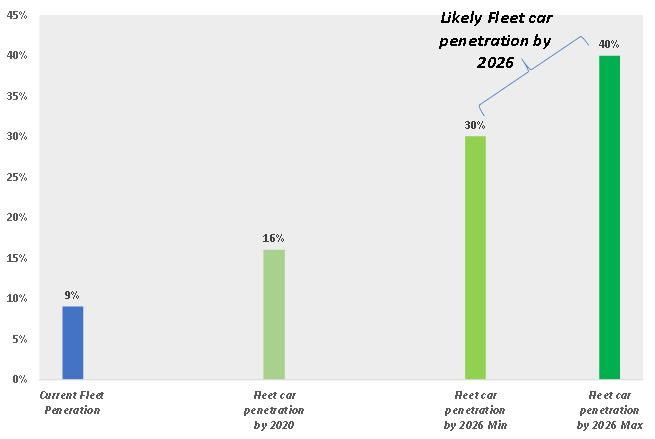

In terms of Auto sales, In FY2016, fleet sales (including cab aggregators) accounted ~9 % of Indian PV sales, which is expected to reach 15% – 17% level by FY2020, according to a report released by ICRA recently. We have spoken to Auto OEMs and Fleet operators in India and there is a general consensus that the fleet car penetration will increase to a minimum of 30% to a maximum of 40% by 2026 based on the current visibility of the future as shown below:

The reason why we are talking of fleet cars in connection to EVs is the fact that the fleet cars represent the largest opportunity now for EVs due to these reasons:

- Their continuous operation of more than > 100kms / day – this represents the maximum possibility of this segment having a commercial viable EVs based on today’s battery prices and EV prices with a minimum of government support.

- Presence of innovative firms who are willing to experiment and innovate further with EVs.

- Some firms here have already made a beginning of introducing EVs in their fleets

- According to recent media reports, there seems to be a larger push by the Government to also fund the fleet car segment with incentives rather than personal car users due to a wider impact and the overall focus on pushing towards shared mobility.

Everyone agrees, and we too started with a hypothesis that range of EVs will be the biggest barrier for large scale mass penetration of EVs in the personal cars segment. We then conducted in-depth and qualitative surveys with a sizeable number of consumers (650+) in about 20+ cities and had some interesting findings to present. We have tried to bring a summary of our research below:

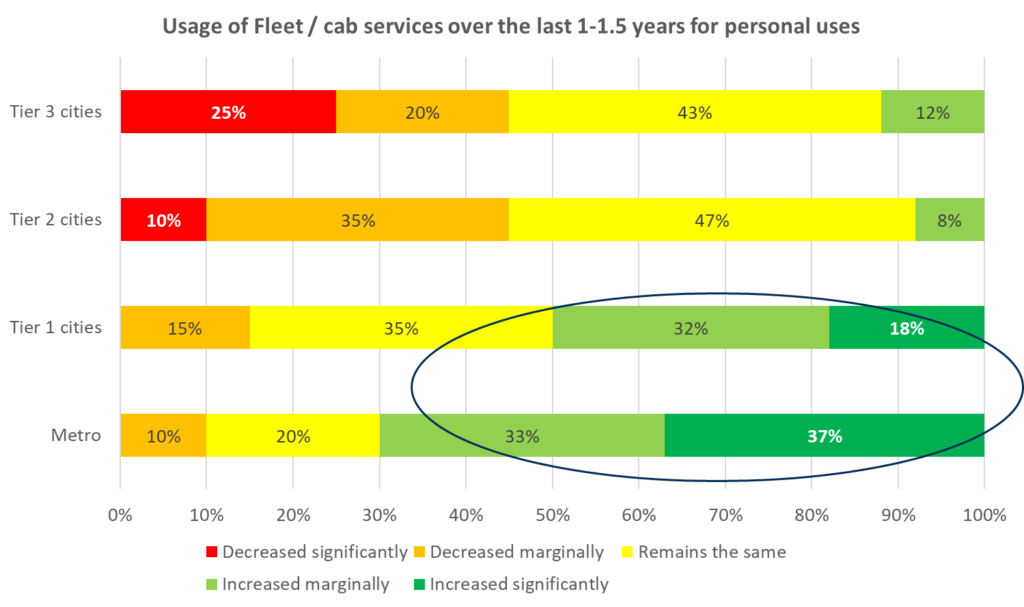

- There seems to be a major change in usage of cars in the Metros and large cities with the App based mobility and much higher portion of the car users seem to be using them these days for personal usage. With EVs coming in the fleet cars more and lowering the operating costs in the long run, this will witness more movement to fleet cars in the future.

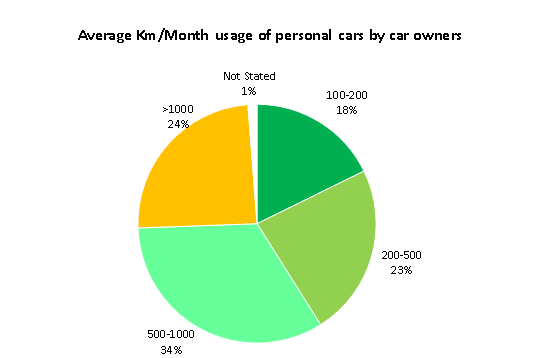

- Even though, there is a talk of range of EVs being limited, the actual usage of personal cars in most cases is limited across the country in the range of 500-700kms / month. This indicates that a major consumer education program is needed to dispel range anxieties and it may not actually be a “real” problem for them to deal with in the long run.

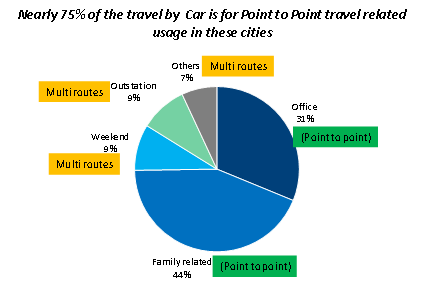

- Most of the travels in personal cars to a large extent are for the ‘Point to Point’ travel with cars being parked for a significant time.

- One crucial advantage which the EVs have over other types of ICE vehicles is that the fuel source here (electricity) is available at their home and one need not always have to go out and get it from a Public fuel retailing center.

- We spoke to certain CNG car users, who usually refill everyday and have to wait for 15-30 minutes during their “Peak day hours” (mostly during going home from work). 78% of them preferred that they would be happy to charge in the comfort of night if given an option instead of spending 20-25 minutes during the day at a fuel station.

- Our sense is that this aspect of “Electricity” being available at the comfort of their homes for charging may be the biggest driver for EVs if the consumers are educated more on this aspect.

- High quality, affordable EVs and good looking cars are the Top 3 expectations on EVs