EVs are a reality in India

Feedback Consulting has been in the forefront of studying the developments in the EVs business in India having worked for stakeholders across the value chain from an OEM, Auto component firm, EV chargers, Charging infrastructure firm and even Batteries for EVs since the 14-15 months.

Recently, we have come up with a Multi-Client Mega Trend Report on the future of EVs, EV charging infra and the EV chargers business in India along with a perspective of car owners in India on EVs. This study has bought some interesting facets which are set out below.

Will EVs happen in India?

EVs are a reality for India, driven largely by global developments on EVs, our fuel risks and climate obligations. The Auto industry, being a dominant part of our manufacturing ecosystem and employment generator, will be severely impacted if we do not invest and get into EV manufacturing and development NOW. We are already late and will be left with dealing with vehicle and components imports later on, which may be a death knell for this key industry.

The Government of India has recognized this aspect and they are going all out in bringing about a Shared / Connected and Electric mobility for India. They have started the work of seeding the industry with bulk procurements, incentives and setting up the mharging infra. A Draft National Auto Policy was released recently, and a final policy may be announced soon. Apart from the other aspects, there is a special focus on preparing the Auto industry to move towards the Green mobility era – Green mobility that includes all possible “Green Technologies” including EVs. A lot has been discussed about the Government’s U turn on the EV policy, whereas a careful reading of the National Auto Policy shows that India is indeed looking for a Green mobility in the future but will be technology agnostic, while it concurrently aims to improve the current status of Indian Auto & Auto component industry and investing in key areas of R&D and skill up-gradation. It also specifically talks on Green mobility (which includes EVs along with hybrids, alternate fuels, fuel cells etc) in the following specific areas:

- Finalize a technology agnostic green mobility roadmap through evolution of emission and fuel consumption standards, along with incentives plan and related infrastructure investments.

- Use the Government e-Marketplace (GeM) portal to aggregate all green vehicle orders from government departments, with standard specifications over three months and enable bulk procurement.

- Conduct a detailed study on requirement of public infrastructure for Green Vehicles to determine the quantity, density and mix of green mobility infrastructure required in the country as per target adoption plans. Also, standards for green vehicle infrastructure in terms of power supply, connectors, refueling etc. will be proposed.

While, it may not specifically say EVs, it talks about Green mobility which includes all possible technologies and EVs are indeed part of this. At this point, I would summarise by saying EVs have NOT been ignored by the Government of India and it would be not right for the commentators to assume that we are banking on ICE only.

The Auto industry also realizes this aspect and players are beginning to take positions. This segment is likely to witness massive movements in the near future.

How will EVs pan out in India?

The likely Indian EV market will be very different than the EV markets worldwide as the dynamics of Indian economy, market needs and consumer attitudes are going to be very different. This has been summarized below:

- For a country obsessed with “Kitna degi?” / mileage, EVs will find buyers as the market matures and once the shift starts, it will be difficult to stop.

- Indian EV market will be primarily driven by Public mobility, followed by personal vehicle ownership.

- Public transportation vehicles such as buses, 3W auto and e-rickshaws and fleet cars will be first movers for the EVs than personal vehicles

- The economics of EVs for these applications far outweigh the initial cost disadvantage.

- Government’s push towards public mobility with some fiscal support and bulk procurement will aid this shift.

- Unlike other markets, Indian EV story will not be led by Government fiscal incentives – while there will be initial and limited support for EV adaption, no large scale support from the Government of India / states for these vehicles for personal ownership

- India is home to one of the largest 2W population in the world and this will witness a fast shift to EVs as it has the inherent advantage of easy charging.

- Personal cars will have a slow shift in the initial 2-3 years till major Auto OEMs come with their range and variety and then the movement will have its momentum. Even in personal cars, there will be space for both the entry level, mid-range sedans and the luxury vehicles at the top end. A lot more investment in charging infra and new business models will have to looked at before we see a mass adaption here.

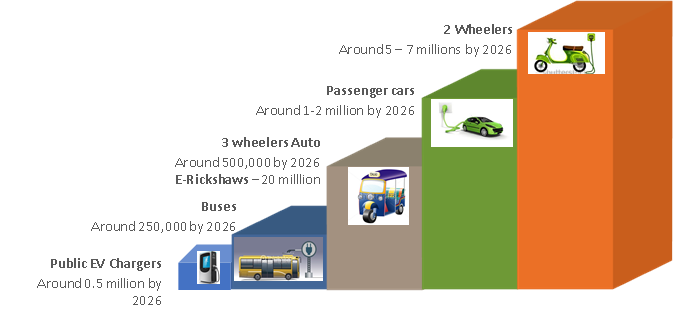

We have made a detailed analysis of the likely future market for EVs and EV chargers by 2026 and by vehicle categories based on various assumptions and scenarios. Our forecasting model essentially revolves around the 2 major inputs available so far in terms of projections:

- The SIAM (Automotive Industry body) projections of auto till 2026 in their AMP 2

- The Niti Ayog report on likely EV penetration

We have used these 2 scenarios and have spoken to the industry representatives and have further split the market according to relevant categories – such as Fleet cars Vs Personal cars, CV – Commercial Vs Passengers etc and have built projections for EV penetration till 2026 as shown below.