With the soaring number of vehicles reaching the end of life of vehicle in India, both the government and private sector are looking at adopting best practices being followed by other developed nations in ELV recycling.

Currently in India, scrapping is carried out in the informal sector and in poorly equipped units, resulting in unhygienic practices and low yields. India lacks a specialized scrap car collection, treatment, dismantling and recovery infrastructure. Over 70% of an automobile by weight consists of metals like steel, aluminum, copper, lead, etc., which are relatively easily recovered. With appropriate technologies, substantial quantity of rubber and plastics can also be recycled.

Considering the need of the hour and the huge underlying potential of the industry, India is in the process of finalizing regulations on recyclability and disposal of End-of-Life Vehicles (ELVs). Government of India under the Ministry of Road Transport & Highways is drafting a new scrapping policy or end of life policy, wherein rust bitten, smoke coughing, dilapidated End of Life Vehicles aka ELVs, causing safety and environment hazards would soon find a way to be scrapped in a systematic manner. The Society of Indian Automotive Manufacturers (SIAM) has established a group to deal with the issue of recycling of End-of-Life Vehicles.

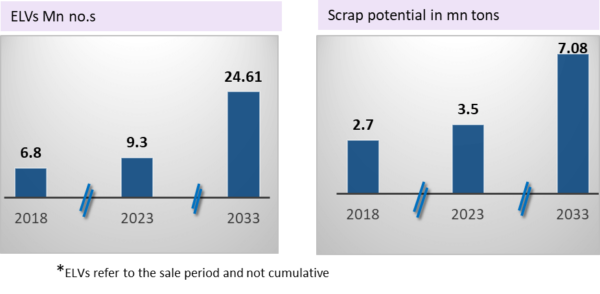

In 2018 itself 6.8 million vehicles had reached their end of life (estimated based on current practices of vehicles dismantled). Rests continues to be used or are often sold to buyers from smaller towns and cities.

Current ELV Practice:

Currently, there is no legislation to deal with the life-cycle of a vehicle. The vehicle dismantling process is manual, unscientific and hazardous to the environment. Only small quantities of noble metals like platinum and radium are extracted for recycling while engines are returned for further use. Most residues make way to landfill sites. All western countries have laid down rules for taking vehicles off roads after certain years and dismantling and recycling them. Increasingly, developing countries are following the suit.

It is a million-dollar business and it is high time even India adopts the best practices followed by western countries. The current ELV dismantling set ups in India lacks latest auto-shredders and related equipments to break ELVs and extract valuable materials off them. This article provides insights on the adoption auto-shredding model in India.

Auto-Shredder and impact of its adoption in India:

The shredding of automobiles and major household appliances is a process where a hammer mill grinds the materials fed into it to fist- size pieces. The shredding of automobiles results in a mixture of ferrous metal, non-ferrous metal (e.g. alloys of copper and aluminium) and shredder waste, called automotive shredder residue or automobile shredder residue (ASR). ASR consists of glass, fiber, rubber, automobile liquids, plastics and dirt. The auto-shredder is currently not being used in India.

India being the third largest producer of steel in the world carries a huge potential in auto-recycling. Being a thoroughly unorganized market, auto shredding model in India can add numerous benefits in the nation’s kitty, beginning from a push to the automobile sector to savings in fuel and less dependent on steel imports.

With domestically generated steel scrap falling short of what is required by steel-makers and the casting industry, India has been resorting to imports. The share of scrap in steel making is almost 25% currently. This is of significance as steel produced from scrap requires 75%less energy. Evolving role of scrap will potentially be a function of domestic scrap availability led by government policies led by ELV.

MSTC Limited, a Mini Ratna Category-I PSU under the administrative control of the Ministry of Steel, Government of India and Mahindra Intertrade Limited (MIL) in a recently drafted MoU joined hands to set up the first auto shredding plant in India. The plant will be the first in the series of such auto shredding units to be built in the country. India’s foraying into the auto shredding market is also a step ahead in the Make in India campaign.

While we speak of increased availability of domestic shredded scrap, it becomes imperative to mull upon its impact on import of the material. It is estimated that 6.8 million vehicles can yield approximately 615,000 tons of steel which could bring scrap imports down at a large scale and auto-shredder can play a vital role in this.

In summary

India needs to look at developing an ecosystem that addresses the entire value chain of the business, put in place practices for ensuring safe disposal of vehicles and also specify the basic standards that need to be adhered to.

With Make in India campaign eyeing 300 MnT steel capacity, the requirement of raw materials is bound to increase. Given the current market for scrap in India, the addition of indigenous scrap from auto-shredding will put Indian manufacturers in a position of advantage. India recently saw its 18th shipment of bulk scrap. The demand for the raw material is consistently growing. Shredding of automobiles and white goods will increase scrap availability in the country, which is the need of the hour since India’s demand for steel is expected to grow in the coming years. As such, while import of scrap will continue, enhanced domestic availability will do good to the steel industry.

While MSTC’s move is a good initiative, channelizing all scrap development through MSTC alone may not be a possible move rather the participation from private sector should be encouraged. A mix of private and public sector working in competition will be more efficient.